According to the Companies Act 2013, a Company that is incorporated under the Act or by any law is called the company. Otherwise Company registration in Salem defines the company as; a company is a legal entity that is formed by different individuals to generate profits by means of commercial activities. There are different types of the company’s existing they are: Private Company, public company, One Person Company, Limited Liability Partnership Company, Section 8 company and so on. Among these Section 8 is non-profit Organization. There are many ways to register the Section 8 Company.

Section8 Company

Company registration in Salem explains about the Section 8 Company. The Section 8 is an NGO was formerly known as Section 25 is a legal form of non-profit organization. This is described under Section-8 of companies Act 2013. The Section 8 Company has the following objectives. They are: arts, science, commerce, education, sports, research, religion, charity, social welfare. Whatever the income earned by this company is used for the above said objectives.

Company registration in Salem states the following requirements for Section 8 Company. They are: There should be any 2 Directors, 2 shareholders; at least one of the Directors should be citizen of India, no minimum capital. The license of the Section 8 Company is given by the Central Government and the power can also be delegated to the Section 8 Company in the place where it will operate. The Section 8 Company no needs to suffix ‘pvt’ or ‘public limited’ like that. It may be called as Association, Federation, Chambers, Council, Foundation etc likewise. Usually it takes 30-40 days for the registration of Section 8 Company.

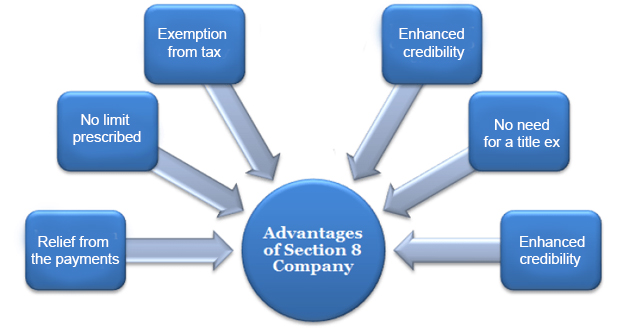

Benefits of Section 8 Company

Company registration in Salem states the following benefits of Section 8 Company. They are: the liability is limited. If there is liability it is limited. Which means the personal asset is not touched. It is limited to the sum of the company. It is a separate legal entity. The succession is perpetual. Which means the succession is never ending. It has lesser compliances legally when compared to the others. It is very easy to transfer the shares. And also there are various tax benefits.

Procedure for registering the Section 8 Company

Company registration in Salem states the procedure includes the name selection. The PAN, identity proofs and the address proofs of the Directors and the shareholders should be submitted. The proofs include;

- Aadhar card

- Voter ID

- Passport

- Driving license

- Bank statement

- Electricity Bill

- Gas bill

- Telephone bill

- Photos

- Contact number

The process of Company registration in Salem is initiated by obtaining the DSC (Digital Signature Certificate) of the Directors and the application to be filed for obtaining the name approval. The name that is reserved is valid for 20 days. Then e-Form INC 12 should be filed. On obtaining the license the INC 32, INC 33 and INC 34 should be filed for the final approval of the ROC. On completing all the above said formalities the certificate of incorporation is obtained.

Company Analysis

Company registration in alagapuram pudur Salem explains about the company analysis has answers for the inevitable questions like liquidity, risk, profit growth, asset value and cash flows. Thus the overall picture of the company is shown and it is known as ‘fundamental analyses. The corporate financial health, productivity and the feasibility are the main focus. The company analysis is used for the stakeholders. T is also helpful for the board of Directors. If the company is producing products it will be tested how many products are doing well with the amount spent. And according to the analyses the products are encouraged to produce. So the companies’ growth is dependent on the company analyses. Hence the company analysis is responsible for the financial status. It has the cash flow analyses which give the status of the money in and money out. There are analyses on the company’s debt and on the investments. There is profitability and the related growth. The workflow analysis of the efficiency is achieved. It sees to the average hours of doing the work and the average productive hours. The employee program, marketing campaigns performances are seen. There are changes in banking and the FDI policies and change in the demographics. Hence company analyses are important in a company.

Start-ups should be as private companies

Company registration explains why start-ups should be started as private companies?

The start-ups should be companies in form of private sector for the following reasons. The reasons are: It can have the tax benefits, it will have limited liability, it will have the international access, credibility and the shares can be easily transferred. Being a separate legal entity it will have tax benefits. If the annual turnover does not exceed Rs. 25 crore and the special exemptions are also provided in case the start-up is a private company. The Board of Directors is responsible for the management. Many people can be hired to manage the products and the other aspects of the company.

Division of company

Company registration in sevvapet Salem states that Companies can be divided in two types based on the basis of control. They are holding company and the subsidiary companies. The holding company can hold 50 % of the shares. It is called holding company or the parent company. Also it can be defined as the company which has more than one company is called the holding company. The company has sister concern for it. They can do managerial decisions and can influence the control. It is defined in the section 2(46). The next category is subsidiary company. The subsidiary companies are held by the other companies. They are also called as sister concerns. The subsidiary companies are held wholly or partially. The company which is held by the other company by means of Board of directors is called the subsidiary. This is defined under Section 2(88). If it is held wholly it is called wholly owned subsidiary company and if it is held partially then it s called partially owned subsidiary company.

Dormant companies

Company registration in Salem explains about the dormant companies. The dormant companies are described under the section 455 of Companies Act 2013. They will hold an asset and the intellectual property and they do not have significant business and also they have plans for future projects.